Current state of the insurance industry

For many years, incumbents were at peace knowing that although they didn’t promote brand love, customers would remain since they didn’t have anywhere else to go. However, their once-insulated industry was flung wide open. New technology-savvy players have been entering the insurance sector, bringing the full force of their innovative, disruptive, opportunity-laden power.

With the rising consumer expectation for digitalization, and the development of technology, comes the fragmentation and verticalization of the insurance industry. A new generation of insurance companies, InsurTechs, have leveraged the power of big data, technology, Internet of Things, Artificial Intelligence, targeted GTM models, etc. to create an innovative product in an industry usually controlled by legacy, generalist incumbents.

Traditional insurers are disrupted not only by the rising competition of smaller, specialized InsureTech firms but also experiencing pressure from customers who struggle with rising inflation, interest rates and loss costs. As the cost-of-living spikes, consumers think twice about their expenses, including their insurance. Some renegotiate their contracts, while others look for the most cost-efficient option.

In this competitive environment, and with the rising churn rate as a result of inflation, insurance providers should step up their game when it comes to retaining their customers and remaining relevant. A seamless user experience, 24/7 customer support and retention/loyalty programs are now more important than ever!

New players in the InsurTech industry & Trends

A fragmented value chain and scarce digitalization of processes have always characterized the insurance industry. However, this has allowed for the entrance of tech-enabled insurance providers which have leveraged on the lack of digitalization in the industry.

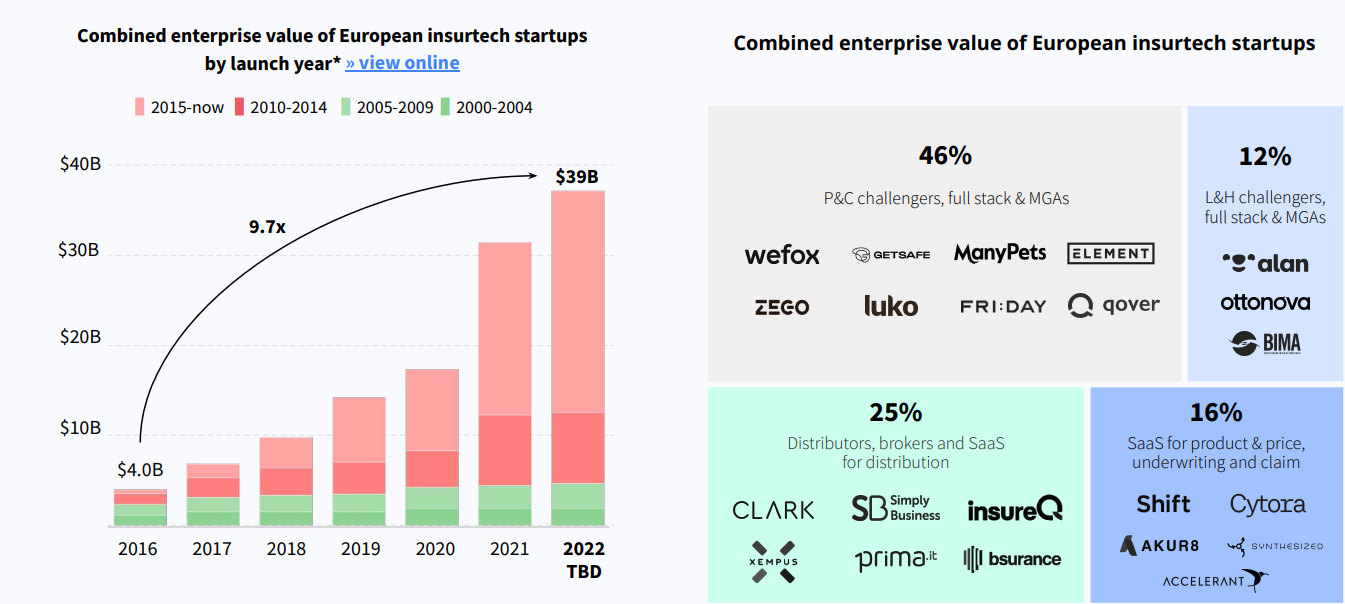

Today, one can observe a growing diversity of capabilities and business models in the InsurTech market. In fact, the market has experienced rapid growth in funding over the past years – $43 billion between 2016 and 2022 (TechCrunch, 2022) and new actors in the industry have started to emerge such as, Kin Insurance, Marshmallow, Getsafe EVY, FloodFlash, RiskWolf, Penni and so many others. For instance, the combined enterprise value of European InsurTech startups is valued at $39B, 9.7x times more than in 2016!

The combined EV of European Insurtech companies is now 39 billion, 9.7x times more than in 2016.

This rapid growth also comes from the increased customer expectations of instant digital transactions sustained seamlessly across digital channels. In fact, customers today expect the same smooth and customized digital experience when it comes to insurance as the one they get from other service providers. Those heightened customer expectations push insurers to embrace new technologies and customer-centric business models.

The key trends that have been shaping this industry include:

The rise of embedded insurance:

- Embedded insurance is a flexible model that allows insurance coverage to be associated with purchasing a product or service. It enables a third-party provider to integrate insurance products into its customer journey. There is a growing trend towards it because of a growing use of open application programming interfaces (APIs) which seamlessly integrate insurance products and solutions into customers’ digital journeys.

- For vehicle manufacturers, banks and other partners, adding insurance products to their ecosystem can increase revenue and improve value propositions, benefiting distributors and insurers.

The broadening of the insurance services ecosystem:

- Today’s most valuable assets, typically intangibles such as software and intellectual property, are underinsured, while physical assets are becoming increasingly vulnerable to climate change. The insurance sector still has the most part to figure out how to offer coverage for intangible assets (service contracts, intellectual property, goodwill, software, data, brand, etc.)

- Insurtechs are working with specialized startups in niche markets like cybersecurity to address this, and they are also pursuing alternate types of insurance like parametric insurance, which offers predefined payouts in the event of trigger events like floods.

Consumer demand for perfect convenience and a seamless customer experience

- Rapid automated claims fulfilment and quick customer support have become the norm in the insurance industry. What was once a competitive advantage, InsurTechs have turned it into a standard.

- Not only has the rapidity of managing claims become a norm but so did the seamless user experience of customers through an insurance’s online platform or self-service. 24/7 customer support has also become a standard in the industry to handle customers’ requests all day long.

A market evolution, beyond insurance services

- Both mature and incumbent InsurTechs are no longer only offsetting risk. They are concentrating more on preventing or reducing risks.

- It appears that insurers are turning into service companies as a result of the addition of a variety of add-on services in industries like healthcare, for instance. The fact that insurers and InsurTechs are expanding towards ‘beyond insurance services’ is fueled by the availability of contextual data and is shifting the role of insurers into service companies. ‘Beyond insurance services’ include for example risk analysis, prevention, and replacement services which are to be considered when designing a new product (e.g. cyber), as well as adjacent services like health benefits. This only means that the value-added service layer is expanding while the insurance slide is shrinking.

Insurance is broadening, and incumbents are partnering to offer a broader ecosystem of services

The combination of new customer expectations, accelerated digitalization, increased availability of emerging technologies (AI, IoT) and the reached maturity of the wave of first InsurTech startups in fueling a rapid transformation. In the past years, most of the focus has been on the distribution layer, but now the attention is embracing all key industry processes and expectations (rapid treatment of claims, fast responses, seamless digital and customized experiences) to remain relevant in a competitive environment!

How can The Nest by Webhelp, an outsourcing partner, support insurance players throughout the entire customer journey to help them retain and acquire customers?

To remain relevant in today’s uncertain global economy, ever-changing industry, and competitive environment insurance players have to step up their game.

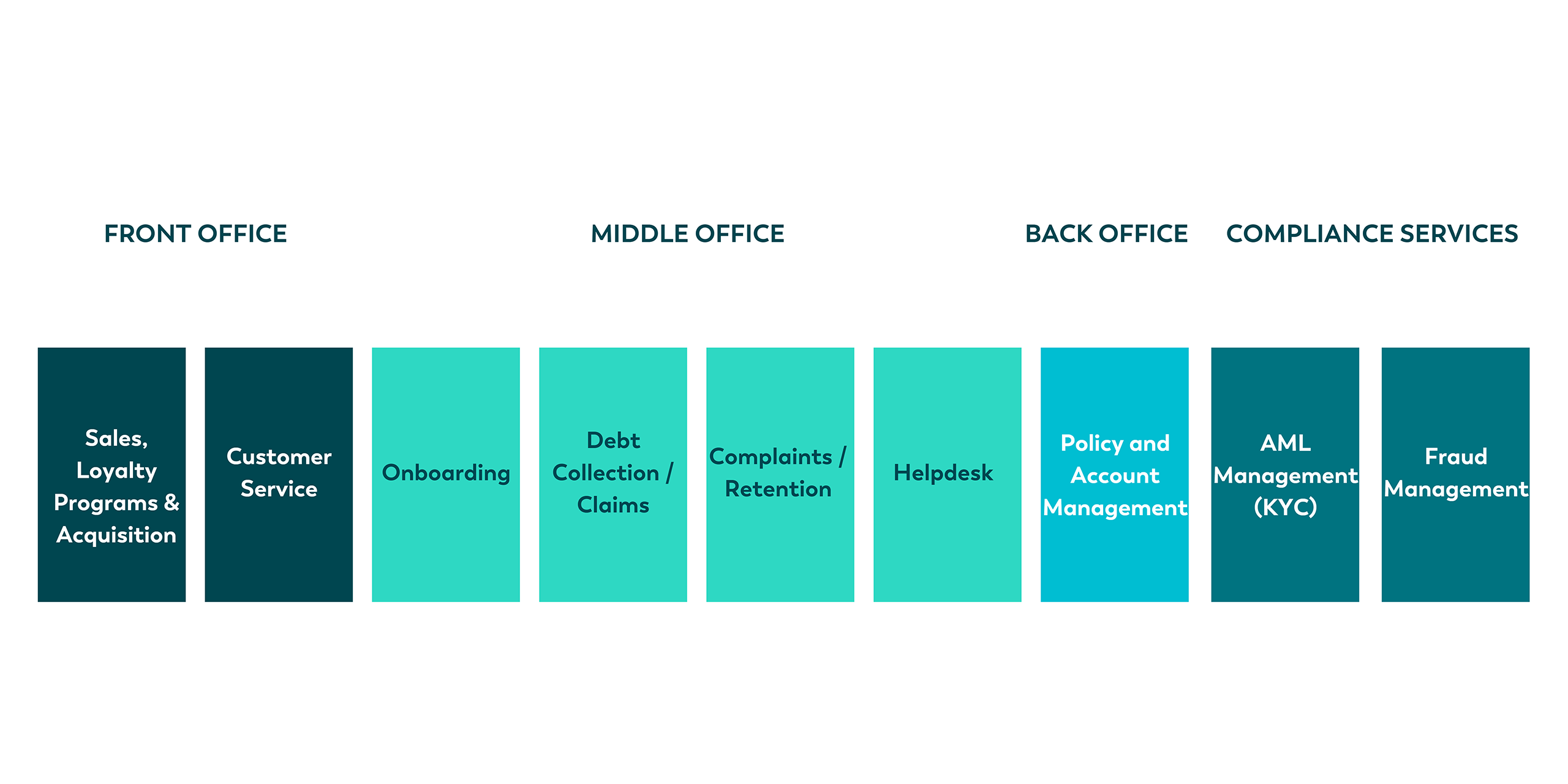

We support you from A to Z:

Below is a short checklist that can help you reach that objective:

1- Building seamless and personalized customer journeys

Why?

First, insurance players should offer their customers the seamless and personalized customer journey they are expecting in order to retain them. Historically, insurance providers relied heavily on offline touchpoints and in-person customer interactions as customer acquisition and retention tools. However, with the development of digital experiences across various industries, customers also expect a seamless experience with their insurance providers. A differentiated customer service experience has become the leading competitive differentiator within the industry.

How?

The Nest by Webhelp can first support you in obtaining a deeper customer understanding. With our data analytics capabilities, we can help you get a better understanding of your consumer’s needs and help you reach proactive personalization.

We also enable you to maintain a competitive edge in the highly regulated world of insurance and compensate for the lack of physical touchpoints, by providing simple interfaces and all-inclusive support for your customers, from onboarding to user-friendly claim management.

With 24/7 multilingual customer support, customers can feel reassured and heard by the insurance provider, consequently strengthening their trust and loyalty to the provider.

2- Providing a rapid treatment of claims, optimizing your costs

Why?

Consumers expect speed and efficiency in all their interactions and insurance providers are no exception. A seamless and rapid claim process is therefore critical to gaining the trust that builds a strong brand and loyal customer base.

How?

The Nest by Webhelp can implement a team of experts that will help you accelerate your claim management process and enable you to respond to your customers in no time.

Additionally, we can increase your efficiency by automating part of the claim processing. We’ve got the technology to replace manual methods with claims technology, which can increase your efficiency and reduce costly errors. Utilizing a claims management system with streamlined automation can also help claims cycle times decrease allowing the reallocation of resources towards high-intensity claims, customer retention, and other opportunities.

In this competitive environment where pricing has become a key success factor, it is crucial to optimize your cost. In this regard, The Nest by Webhelp can support you in improving your cost structure to maintain or reach a ‘top-of-mind awareness’.

3- Building proactive pre- & post-sales processes

Why?

In these uncertain times, customers are thinking twice about their expenditures, it is thus crucial to adopt a proactive approach when it comes to customer acquisition and retention in terms of sales.

How?

The Nest by Webhelp can support you by implementing a team of sales experts equipped with an industry-specific and omnichannel approach who can continuously improve your performance. With the right selling processes and end-to-end monitoring, we can optimize productivity and results.

Moreover, we deliver flexible sales management to support continuous changes in demand fitting your needs.

4- Creating strong loyalty and retention programs

Why?

Loyalty programs enable you to retain their existing customers more effectively. An insurance loyalty program designed around making the customers feel more valued than mere purchasers of insurance plans is more likely to help in fostering long-term relationships. Additionally, with loyalty programs, you can easily aim for upselling and cross-selling opportunities.

How?

With our retention and loyalty services, you can easily avoid the “one size fits all” because we’ll get insights and analytics to better understand your customers and deliver personalized experiences.

Check out how we helped our customers retain their customers

Contact us to help you retain and attract more customers!