One of the most-discussed topics in and around the European start-up cosmos during the last six months has without a doubt been the financing battle of the Thrasio clones. Startups are buying up Amazon sellers in order to continue their business in consolidated groups. Although the startup scene is used to hotly debating trends and innovations, the diversity of opinions regarding the “FBA buyers” is quite unique: Where’s the innovation? What’s the endgame? What do investors see in this model? Who will survive in the market? How will it change e-commerce?

These are just some of questions being asked. Therefore, this article is going to look at some of the aspects of this Thrasio fever in the European startup and digital scene. Because for us, as a company with a strategic view that is deeply rooted in the operative processes of our customers, the central question that arises is: How can one position oneself as an FBA buyer among the competition and establish oneself in the long term?

What is the FBA buyers’ business model?

What is it actually all about? The business model of the FBA buyers (hereinafter “buyers”) is to successfully (i.e. profitably) buy up Amazon sellers and brands (hereinafter “targets”), to consolidate them and attain better margins by leveraging economies of scale and optimising processes in the following phases:

- Operational optimization

- Marketing optimization

- Portfolio expansion

- Regional expansion

- Channel expansion

In other words, it comes down to bringing together a group of individually successful targets and making them even more successful in the form of a larger entity. This promises enormous potential, particularly in fragmented markets. This business model requires that the targets use Amazon’s FBA (Fulfilled by Amazon) logistics structure to store their products in Amazon warehouses, and automatically send them and, if necessary, process returns.

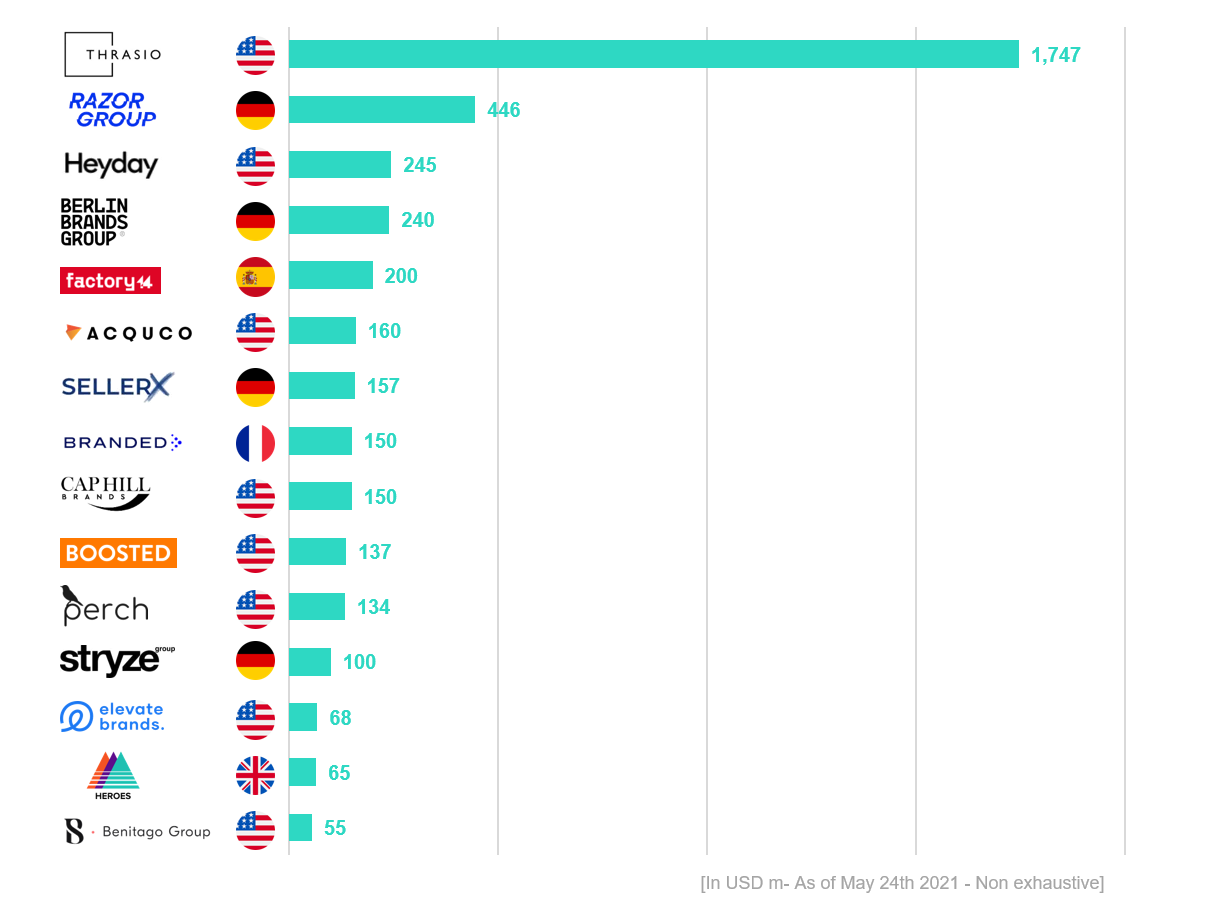

The initiator of this business idea is considered to be the American startup Thrasio, which has raised growth capital of around 1.5 billion euros (as of April 2021) since its founding in 2018. Financing for this business model is usually made up of “classic” venture capital (in the sense of equity financing for establishing and growing a business), as well as debt financing – in other words, different forms of borrowed capital in order to finance the takeover of targets.

Who are the most important players in the market?

Following the lead of their US role model, numerous European startups have been founded in recent months, all with the very same business objective. Among them, SellerX, Heroes, Branded or the Razor Group differ primarily in terms of the amount of funding they have been able to raise and the aggressiveness of their market penetration. Along with these acquisition vehicles, the market is complemented by various players who already have a great deal of experience in brand building and e-commerce structures, e.g. the Berlin Brands Group (BBG), the Stryze Group and the One Retail Group.

Where are the challenges when acquiring targets?

Data and estimates regarding the size of the European market vary. The fact is, the attractive targets will have been bought up within 18 months at the latest. In markets driven by growth, this will inevitably be followed by a consolidation phase (buyer buys buyer), which is followed by an intensified geographic expansion, before a possible exit during the “operative excellence” phase. This phase will also encompass an even more aggressive “channel expansion”, i.e. taking successful brands out of the Amazon environment and into direct sales via their own shop or distribution through brick-and-mortar retailers.

This process entails a number of challenges: on the one hand, the buyer has to acquire the best targets in a limited pool as efficiently as possible in order to improve his position when negotiating in the consolidation phase; on the other hand, the integration and merging of the targets must be mastered as smoothly as possible in order to survive the final market phase by means of operative excellence.

All in all, in addition to consolidation of product-specific value chains, centralised marketing and an integrated software environment play a decisive role. Beyond that, the buyers must of course manage everything from SEO and listing optimisation to prefinancing of production, right through to packaging as well as the product life-cycle and innovation. However, the most important factor is and remains the team. This is because the FBA game is like every direct-to-consumer business (hereinafter “D2C”): It may be a money game, but above all it’s a people game!

The reason why customer experience is the key to success

The optimisation of processes is at the heart of this business model. Consequently, buyers – because they do not always take on the target’s team – have to bring seasoned customer experience experts on board. Because not only is cross-category product expertise vital to success, but also the platform-specific understanding of Amazon clientele.

Furthermore, the requirement for multilingualism is also an optimisation issue. Experts agree that the Thrasio clones will be fighting it out for market supremacy not only nationally, but on a pan-European battlefield. In addition, pressure will increase when Thrasio and other US buyers ramp up their activities in European markets at the very latest. Therefore, all CX structures, in particular Customer Care, must be set up in flexibly scalable processes in order to keep the knowledge base comprehensible and quickly transferable.

How we are going to help our customers achieve operative excellence

For many of our D2C or marketplace business customers, we therefore focus upon centralised solutions with dedicated expert teams. We are able to simultaneously serve all European markets by means of hubs specialising in customer care, and do this 24/7/365. During peak periods (e.g. Black Friday or the run-up to Christmas), we will simply make additional manpower available, as our training measures always run parallel to the actual business.

Furthermore, we have at our disposal a tried-and-tested, continuously improved measurement and control system, with which we can report all relevant KPIs (AHT, CSAT, etc.). The optimum automation of all processes is also one of our priorities. This enables us – in close agreement with our customers – to achieve more cost advantages and to optimize performance, too.

As an integrated outsourcing provider, our approach is always strategic. We support our customers across all channels in the brand-building phase, during market conception and execution, as well as with all SEO and listing processes. It is only by treating all touchpoints in the customer journey holistically that the best possible CX can be guaranteed.

Our conclusion

Ultimately, survival in the market will depend on a focus upon CX. Whether this “survival” means a sale, a merger or a successful SPAC or IPO exit remains to be seen. It remains equally open as to whether the amount of funding (SellerX, Razor Group, etc.) or experience (Berlin Brands Group, etc.) will prevail. First and foremost, the group of experienced brand builders will probably have an enormous advantage in the channel expansion phase. The FBA business will definitely be making one or two or more headlines in the coming months, and we will be keeping an eye on these developments. Because one thing is clear: Speed is everything, but it’s execution that wins the game!